Tax Resources

Important IRS deadlines and other reminders to help you get the most out of your Eagle View e-filing solution.

Resources

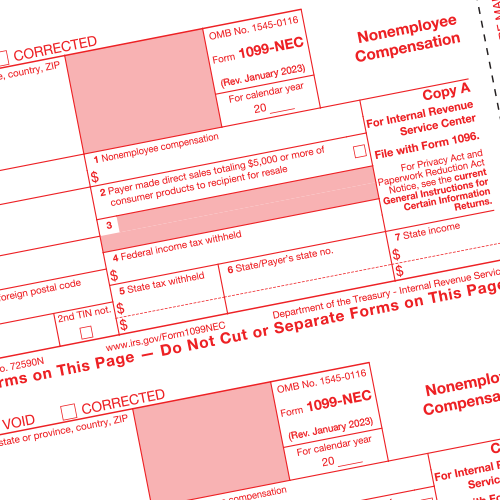

Form 1099 Filing Deadline: January 31, 2024 W-2 Filing Deadline: January 31, 2024 Printing and Mailing Deadline How to improve annual performance reviews of your employees What’s your biggest business problem? How to profit from customer complaints Keep your customers coming back Keep an eye on your company's cash 16 Reasons To Make the Right Choice in JanuaryForm 1099 Filing Deadline: January 31, 2024

- Both electronic and paper versions of Copy A and Copy B of 2023 1099-NEC forms must be filed with the IRS and furnished to the recipient by January 31, 2024.

- For all other 1099 forms, Copy A is due to the IRS by February 28, 2024 if paper filing, April 1, 2024 if filing electronically. Copy B is due to the recipient, paper and electronic filing, by January 31, 2024.

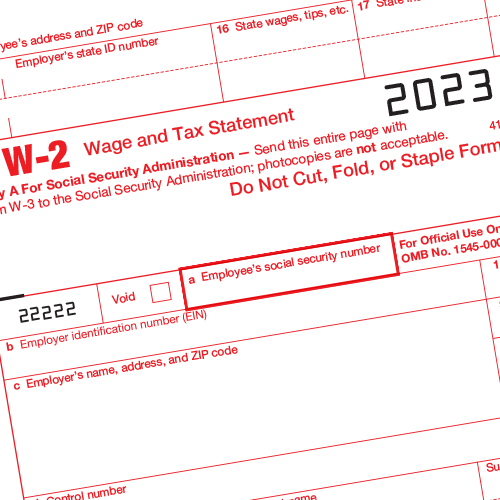

W-2 Filing Deadline: January 31, 2024

- Both electronic and paper versions of Copy A and Copy B of 2023 W-2s must be filed with the Social Security Administration and furnished to recipients by January 31, 2024.

Printing and Mailing Deadline

In order for us to print and guarantee mailing your forms by the January 31st deadline, you must complete your order no later than noon (PST) January 30th. Orders placed after Noon (PST) January 30th are not guaranteed to be printed and/or mailed by the January 31st deadline.

How to improve annual performance reviews of your employees

The annual employee performance review usually it's dreaded by both supervisor and employee. The employee knows he'll have to hear about those mistakes from months ago, and the supervisor will finally have to discuss those issues he's been avoiding all year. Too often, the result is discomfort and embarrassment all round. Usually both parties fudge a little and are glad that it's over for another year. Too bad, because another chance for open communication and feedback has been lost.

What’s your biggest business problem?

If you run a business, try this exercise. First, write down what you think is the single biggest problem in your business. Then ask the key people in your company to do the same. Try to include input from all areas of operations sales, manufacturing, personnel, purchasing, shipping, and finance. The number of inputs will depend on the type and size of your business, but make sure you cover everything from internal operations to relationships with customers.

How to profit from customer complaints

Nobody in business welcomes a customer complaint. It usually means taking time out of a busy day to deal with an angry person. But that's the wrong attitude. You should think of a customer complaint as three opportunities in one.

Keep your customers coming back

Every successful business relies on a core group of customers who keep coming back on a regular basis. Sure, you're always trying to find new customers and expand your market. But chances are that it's the "regulars" who provide the bulk of your revenues. It's important not to forget this group.

Keep an eye on your company's cash

Do you regularly monitor your company's cash accounts? You should. Even if you leave the job to your bookkeeper or accountant, you should stay aware of where the cash is going and how the spending is approved. Along with inventory "shrinkage," theft or improper expenditures of cash are among the chief sources of loss for small companies.

16 Reasons To Make the Right Choice in January

It's true. Accountants and tax preparers work their tails off and at this time of year there's hardly any rest until the end of the tax season. Anyone wanting to save themselves some time and money is probably looking for online solutions for their 1099 or W-2 information returns. Here are 16 great reasons to e-file this January

This material may not be published, rewritten or redistributed without permission, except as noted here. This site includes, or may include, links to third party Internet Websites controlled and maintained by others. When accessing these links the user leaves this site. These links are included solely for the convenience of users and their presence does not constitute any endorsement of the Websites linked or referred to nor does Tangible Values, Inc. have any control over, or responsibility for, the content of any such Websites. All rights reserved.